Hi, again!

Welcome to this week’s The Finance Blueprint! Big headlines, bigger drama! This week, President Trump’s tariff delays sent markets into a frenzy, with the S&P 500 dropping 1.8%. Meanwhile, Bitcoin tanked after Trump’s crypto reserve order, and Nasdaq is pushing for 24/5 stock trading. In finance blunders, Citigroup nearly sent $6 billion to the wrong account. Prada and Versace might unite in a €1.5 billion fashion power move, and eggs are now luxury items at $4.95 per dozen. With job market uncertainty and inflation concerns, all eyes are on upcoming earnings reports. Stay tuned—because even breakfast is getting expensive!

📰 The Week in Global Headlines: Mar 02–Mar 08, 2025

Tariffs, Uncertainty, and the Market’s Rollercoaster

President Trump just delayed tariffs on goods from Canada and Mexico—again! But here's the twist: while that sounds like good news, the stock market didn’t exactly throw a party. The S&P 500 dropped 1.8%, marking its sixth straight day of wild swings over 1% in either direction. That’s like watching your favorite designer item go from full price to 50% off, then back up again before you can hit “Add to Cart.” Investors are exhausted—tariff fatigue is so real!

The biggest frustration? Nobody knows what’s next. Will tariffs stay? Will they go? Retailers like Kohl’s, Dollar General, and American Eagle are reporting earnings next week, and all eyes are on them. Rising prices due to tariffs could hit consumers hard, and with the CPI data and Michigan’s consumer sentiment index coming up, we’ll soon find out if people are still swiping their credit cards—or clutching their wallets tighter.

Meanwhile, Bitcoin just took a nosedive after Trump’s executive order to create a “strategic crypto reserve” (fancy!). But plot twist: the government won’t actually be buying Bitcoin—just using the confiscated kind. Investors? Not impressed.

Broadcom’s record AI revenue offers a glimmer of hope, but with the Nasdaq in correction territory, it’s still a bumpy ride ahead. Fingers crossed for a smoother, more predictable spring!

Nasdaq’s 24/5 Trading Plan

So, Nasdaq just dropped some big news—stocks might soon be tradable 24/5. That’s right, no more waiting for the opening bell like it’s some VIP club. They’re chatting with regulators and hope to roll this out by late 2026. But hold on—liquidity issues, trade surveillance, and, well, the whole “who’s actually going to stay up trading?” question still need sorting. NYSE is already ahead with 22-hour trading. Crypto’s 24/7 markets clearly set the trend, and Nasdaq doesn’t want to be left behind. Will it happen smoothly? TBD. But investors worldwide are definitely watching.

Prada x Versace

Imagine this: Prada and Versace joining forces—two Italian fashion legends under one roof. The rumored price? €1.5 billion. If the deal happens, it’s not just a purchase, it’s a power move. Luxury giants like LVMH and Kering have been leading the industry, but Prada is signaling it’s ready to step up. And let’s be honest, Versace could use a boost—sales have dropped 15%. With Prada’s influence (and Miu Miu’s rising popularity), this could be a turning point for Italian fashion, bringing it closer to the dominance of French luxury houses. A big move in the style game.

Oops, Citi Almost Dropped $6 Billion Into the Wrong Account!

Imagine waking up to a $6 billion surprise in your account—well, almost. Citigroup nearly credited a jaw-dropping sum to a client in its wealth-management business after an employee copy-pasted an account number into the wrong field. Luckily, the mistake was caught the next day. Regulators were notified, and Citi has since introduced new tools to prevent such slip-ups. This isn’t Citi’s first blunder—just last month, they briefly credited $81 trillion by accident. With past regulatory fines and compliance issues, it looks like Citi is still working on getting its financial house in order.

SEC Says Meme Coins Aren’t Securities

The SEC just gave meme coins a free pass—declaring that most of them aren’t securities under U.S. law. According to the agency, these digital assets are more like collectibles than investments, meaning no registration is required. But there’s a catch: no protections for buyers under federal securities laws. The decision comes as meme coins skyrocketed post-Trump election, only to crash hard in recent weeks. With regulators finally offering some clarity, crypto investors are watching closely—especially as Solana-based meme coins dominate the space. Regulatory green light or not, the meme coin rollercoaster isn’t slowing down.

💡 What’s latest in the Job Market : The Job Market’s Giving ‘I’m Not Mad, Just Disappointed’ Vibes

Okay, so you know that feeling when you’re waiting for something big to happen, and then it’s just… meh? Well, that’s exactly what just happened with the U.S. job market.

Apparently, in February, the economy only added 151,000 jobs, which is way lower than expected—kind of like when you check your bank balance and realize your weekend “just one drink” plan turned into a full-blown champagne moment. Oops.

And let’s talk about the federal hiring freeze—basically, the government’s acting like that one friend who suddenly decides they’re on a “no-spend challenge” right when you’re planning a big night out. Come on, guys. Meanwhile, January’s numbers were revised to 125,000 jobs, but let’s be real, between wildfires, winter storms, and people still Googling ‘quiet quitting,’ it’s not entirely surprising.

Oh, and the unemployment rate nudged up to 4.1% (from 4%). Still lower than pre-pandemic times, but let’s just say it’s giving ‘I swear I’ll start saving next month’ energy.

The real question? How’s this going to impact your bank account, your morning latte budget, and your ability to justify that absolutely necessary extra shot of espresso? Because priorities.

Stay tuned—because at this rate, even eggs might get a better raise than some of us.

💡Money Moves & Market Magic : Eggflation: Why Your Breakfast Costs More Than Your Coffee

Let’s talk about eggs. You know, those humble, protein-packed wonders that used to be the cheapest thing in your grocery cart? Well, not anymore. If you’ve been to a supermarket recently, you might’ve done a double take at the price of a dozen large eggs—because we’re now officially in the era of luxury eggs.

How Bad Is It?

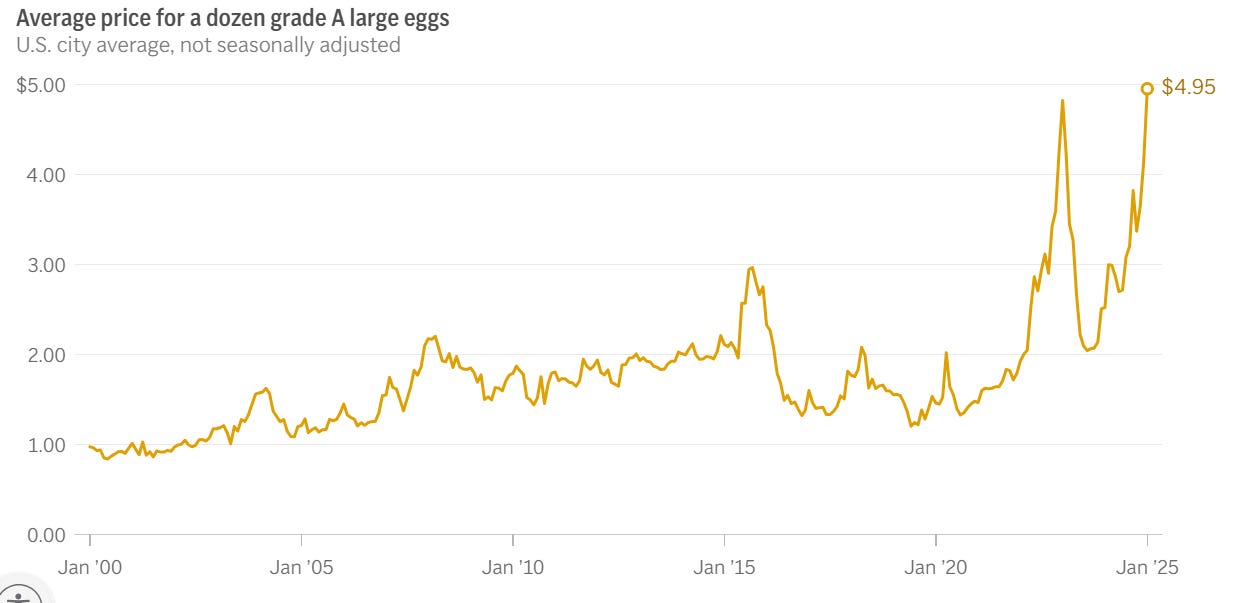

If you feel like eggs have never been this expensive, you’re absolutely right. Just look at this chart:

This graph, straight from the Bureau of Labor Statistics, tracks the price of a dozen Grade A large eggs in the U.S. over the years. And the trend? Egg-stremely concerning. The latest price point? A staggering $4.95 per dozen. That’s a nearly 300% increase from the early 2000s, when you could grab a dozen for just over a dollar.

Why Are Eggs So Expensive?

Several factors have turned eggs into a high-priced commodity:

Bird Flu Outbreaks

Avian influenza wiped out tens of millions of egg-laying hens in recent years.

Lower supply = higher prices. Classic economics.

Feed and Production Costs

Farmers are paying more than ever for chicken feed due to inflation and global grain shortages.

Higher fuel and labor costs also play a role in pushing up egg prices.

Market Manipulation?

The U.S. Department of Justice has been investigating whether egg producers deliberately restricted supply to drive prices up.

Some major egg suppliers (like Cal-Maine Foods) have reported record-breaking profits. Hmm.

Increased Demand

As prices of other proteins (like meat) increase, more consumers turn to eggs as an affordable alternative—except eggs aren’t so affordable anymore.

Government Response: Cracking Down on Prices

With eggs becoming a financial burden for many families, the government is stepping in:

$1 billion in funding is being allocated to support farmers and fight bird flu outbreaks.

Some states are investigating price gouging, questioning whether egg companies are artificially keeping prices high.

The Biden administration is working on ways to stabilize food prices, but let’s be real—when was the last time they successfully controlled inflation?

Eggs vs. Other “Luxury” Goods

To put things into perspective, here’s how a dozen eggs compare to other non-essential luxuries:

Dozen eggs (Feb 2025): $4.95

Starbucks latte: ~$5.50

Big Mac: ~$5.69

Netflix subscription: $6.99/month

Avocado (because millennials love these): ~$1.50 each

Yes, we’ve reached the point where eggs are as expensive as streaming services.

Should You Start Hoarding Eggs?

If you’ve got space in your fridge, it might not be the worst idea. Prices are still volatile, and some analysts warn that we might see another price spike if bird flu worsens or grain shortages continue.

Meanwhile, if you see me at Costco stockpiling cartons like it’s the next cryptocurrency boom, mind your business.

Bottom Line: If you’re buying eggs in 2025, congrats—you’re officially investing in a premium product. Now, if only they came with designer packaging to match.

I absolutely love hearing from you! 💌 Drop me a note and let me know what you loved or what you think could use a little tweaking in the newsletter. Your feedback means the world

👛 Until Next Time…

That’s a wrap for this week, my finance-loving friends! If you enjoyed this, share it with someone who could use a little sparkle in their career strategy.

Remember: You’re more than just your resume, portfolio, or GPA. You’re YOU—and that’s your secret weapon. 💕

Until next week—stay curious, stay fabulous, and keep one eye on the markets (and the other on life’s little joys).

Hey!

I’ve been following your content for a while, and I really enjoy your insights. I also run a Substack newsletter, Trade With Harshath, where I share trading strategies, forex insights, and market analysis.

Since we’re in a similar niche, I wanted to see if you’d be open to a mutual recommendation on Substack. I think our audiences could benefit from both perspectives. No worries if it’s not something you’re interested in—just thought I’d ask!

Let me know what you think. Looking forward to hearing your thoughts!

very good article! I love it and soo true!