Hi, again!

Welcome to this week’s The Finance Blueprint! Big headlines, bigger drama! Trump introduces new "secondary tariffs" on countries buying Venezuelan oil, signaling a potential trade escalation with China and others. Starting April 3, a 25% tariff on imported cars raises prices for foreign-made vehicles, while Tesla remains unaffected. China overtakes Japan as the world’s largest car exporter, driven by a surge in electric vehicles. Siemens acquires Altair Engineering for $10B, enhancing its AI-driven industrial software capabilities. Plus, is the recent 2% market dip a buying opportunity or a sign of more turbulence? Dive in for the latest insights, trends, and finance news you need to know!

📰 The Week in Global Headlines: Mar 23–Mar 29, 2025

Donald trumps threat of “secondary tariffs” invents new trade weapon

This move by Trump is classic economic brinkmanship—mixing tariffs with secondary sanctions to pressure Venezuela and, by extension, China. The idea of "secondary tariffs" is new, and its enforceability remains unclear, but it aligns with Trump’s broader strategy of using trade as leverage. By targeting countries that buy Venezuelan oil, he’s effectively warning China, a major player in the black market for Venezuelan crude, while also leaving room for maneuverability through Secretary of State Marco Rubio’s discretion.

This approach signals a shift away from financial sanctions, which Trump has warned could undermine the dollar, in favor of tariffs, which he sees as both a negotiating tool and a source of revenue. If imposed, these tariffs could escalate trade tensions with China, Spain, and India, creating ripple effects in global energy markets. The next key date? April 2—when we find out whether Trump follows through on this high-stakes economic play.

Trump hits auto imports with 25% tariff starting next week

So, Trump has officially dropped his latest shopping rule, and this one’s a biggie—starting April 3, imported cars will come with a hefty 25% tariff. Translation? If your dream car wasn’t built in the U.S., it’s about to get a lot pricier.

Big automakers like GM and Ford are scrambling, while Tesla? Totally fine. The move is shaking up global supply chains, and dealers might pass costs onto customers. Basically, if you’re car shopping, maybe lock in that deal now.

Indonesia rupiah falls to lowest level since Asian Financial crisis

You know that feeling when you check your bank account, and it’s way lower than you expected? Yeah, that’s Indonesia’s rupiah right now. It’s down 3% this year, officially the worst-performing currency in Asia, and investors are not thrilled.

The big worry? New leader Prabowo’s grand spending plans—like free meals for millions—which sound lovely but could rack up debt. The stock market’s also feeling the heat, dipping to a three-year low. Until investors get clarity, the rupiah’s going to stay in the financial hot seat.

China has become the world’s largest car exporter, surpassing Japan & Germany

So, guess who just became the world’s biggest car exporter? Yep, China. They officially passed Japan in 2023, shipping 4.91 million cars—beating Japan’s 4.42 million. And a big reason? Electric vehicles (NEVs).

China isn’t just making cars; they’ve got a whole ecosystem for NEVs, from batteries to high-tech patents. Even European markets are warming up—BYD’s setting up shop in Hungary! With lower costs and cutting-edge tech, China’s auto industry is driving full speed ahead on the global stage.

Siemens completes $10Billion acquisition of Altair Engineering

Siemens just made a massive power move—snapping up Altair Engineering for a cool $10 billion. And why? AI, digital twins, and a whole lot of industrial software magic.

With Altair’s cutting-edge simulation tech now in Siemens’ toolbox, their Xcelerator platform is getting a serious AI upgrade. This isn’t just about one deal—Siemens is on a digital shopping spree, grabbing companies left and right while offloading others. Bottom line? They’re going all in on AI-driven industry dominance.

Quick Updates You Need to Know!

Tesla extends dismal run in Europe with 40% drop in February

23andMe’s bankruptcy puts millions of users’ DNA info on auction block

Call of Duty has made over $31 billion in its lifetime

X formerly known as twitter, has regained it’s $44B Valuation

Tesla has lost $795Billion since December 17th

Wall street’s average annual bonus rose to $244,700 last year

The $160B ISS will be demolished by a space X Rocket

Seattle millionaires are fleeing to Las Vegas to escape taxes on their wealth

💡 What’s latest in the Job Market : Equal Pay Still a Work in Progress

March 25, 2024, marked Equal Pay Day—the date symbolizing how far into the year women must work to earn what men made in 2023. On average, women earn 83 cents for every dollar a man makes, translating to a $1 million loss over a 40-year career (National Women’s Law Center).

The gap is worse for women of color and stems from occupational segregation, career interruptions, wage discrimination, and lack of pay transparency. Even in the same roles, women often receive lower starting salaries and fewer raises.

Closing the gap requires pay transparency laws, stronger parental leave policies, salary negotiation training, and more women in leadership. Equal Pay Day is more than a date—it’s a reminder that wage equality remains unfinished business.

Have you experienced pay inequality in your field? Let’s discuss.

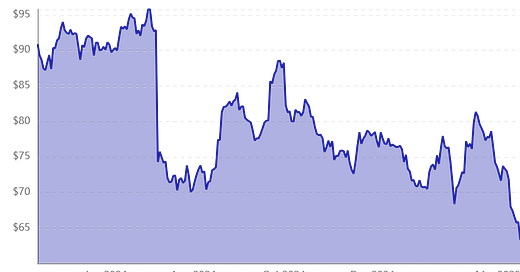

💡Money Moves & Market Magic : Markets Tumble 2%—Is This a Buying Opportunity?

The stock market just took a hit, with major indices slipping around 2% in a single trading session. For some, this signals a moment of panic. For others, it’s a flashing "BUY" sign. But what’s really happening, and should you take action?

Let’s break it down.

Why Did the Market Drop?

Market movements are driven by a mix of economic data, investor sentiment, and external shocks. Here are the likely culprits behind this decline:

Interest Rate Jitters

The Federal Reserve’s stance on interest rates remains a key market driver. If inflation remains sticky, the Fed may keep rates higher for longer, making borrowing more expensive and putting pressure on stock valuations.

🔹 Historical Insight: When the Fed signaled higher rates in 2022, the S&P 500 fell over 20% that year.

Geopolitical & Economic Uncertainty

Rising tensions in global trade, supply chain disruptions, or economic slowdowns in major economies like China can send shockwaves through markets.

🔹 Case Study: The U.S.-China trade war in 2018 triggered a 6% drop in the S&P 500 in a single week.

Weak Earnings Reports

Tech giants, banks, and consumer brands are posting mixed earnings results, raising concerns about corporate profitability. If key sectors show signs of weakness, investors react by selling off.

Market Pattern: Poor earnings seasons in 2008 and 2020 triggered major sell-offs but also presented buying opportunities.

What History Says About Market Dips

A 2% drop may feel significant, but let’s zoom out.

Since 1980, the S&P 500 has averaged a 14% intra-year decline—yet ended positive in 75% of those years.

After a 2% drop, markets tend to recover within 1-3 months if no major recession follows.

Corrections of 5-10% have historically been good entry points for long-term investors.

Example: In March 2020, the market dropped nearly 35% due to COVID-19 panic. Those who bought in saw record gains within a year.

Should You "Buy the Dip" or Stay on the Sidelines?

It depends on several factors:

Your Investment Horizon: Long-term investors typically benefit from buying during dips.

Sector Strength: Some industries recover faster than others (tech and consumer stocks tend to lead rebounds). Market Sentiment: If fear is driving the sell-off rather than fundamentals, it may be a temporary drop.

Risk Tolerance: Can you stomach further losses if the market falls another 2-5%?

Sectors to Watch

🔹 Tech & AI – Volatile but historically strong rebounders.

🔹 Energy & Commodities – Safe havens if inflation remains a concern.

🔹 Financials – Benefit from higher interest rates but can struggle with economic slowdowns.

Final Thoughts: Opportunity or Trap?

A 2% drop isn’t a crisis, but it’s a moment to reassess. If economic fundamentals remain strong, this could be a great buying opportunity for long-term investors. However, if risks escalate (persistent inflation, weaker earnings, geopolitical uncertainty), caution may be warranted.

What’s your move—buying the dip or waiting for more clarity? Drop your thoughts below!

I absolutely love hearing from you! 💌 Drop me a note and let me know what you loved or what you think could use a little tweaking in the newsletter. Your feedback means the world

👛 Until Next Time…

That’s a wrap for this week, my finance-loving friends! If you enjoyed this, share it with someone who could use a little sparkle in their career strategy.

Remember: You’re more than just your resume, portfolio, or GPA. You’re YOU—and that’s your secret weapon. 💕

Until next week—stay curious, stay fabulous, and keep one eye on the markets (and the other on life’s little joys).

Hedge funds were selling while retail was buying the dip on Thursday - retail was being played!